UPDATE: ROC United Celebrates Victory as DOL Issues Final Rule on Tipping for 'Dual Job' Workers

On October 28, 2021, the U.S Department of Labor announced publication of a final rule (Tips Dual Jobs final rule) that sets reasonable limits on the amount time an employer can take a tip credit when a tipped worker isn’t doing tip producing work. It clarifies that an employer may take a tip credit only when an employee is performing work that is part of a tipped occupation, specifically; performing work that is tip producing or performing work that directly supports work that is tip producing for a limited amount of time.

Under the final rule, an employer can take a tip credit only when the worker is performing tip producing work or when:

- A tipped employee performs work that directly supports tip producing work for less than 20 percent of the hours worked during the employee’s workweek. Therefore, an employer cannot take a tip credit for any of the time that exceeds 20 percent of the workweek. Time for which an employer does not take a tip credit is excluded in calculating the 20 percent tolerance.

- A tipped employee performs directly supporting work for not more than 30 minutes. Therefore, an employer cannot take a tip credit for any of the time that exceeds 30 minutes.

- The final rule becomes effective December 28, 2021.

This is a major victory for restaurant workers. Thank you to everyone who helped out.

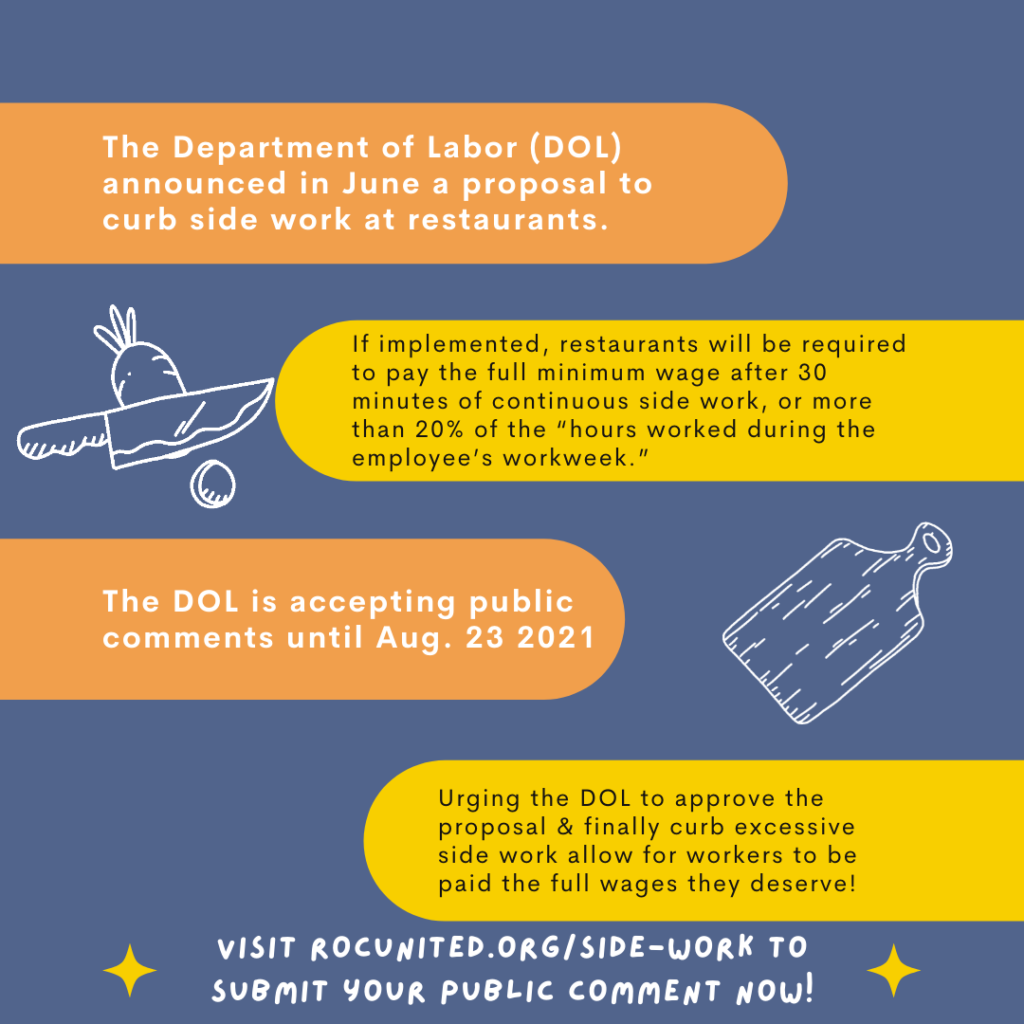

WHAT IS HAPPENING

The Department of Labor (DOL) announced in June a proposal to curb side work at restaurants. If implemented, restaurants will be required to pay the full minimum wage (instead of the tipped minimum wage) after 30 minutes of continuous side work, or more than 20% of the “hours worked during the employee’s workweek.”

HOW YOU CAN HELP

At this time, the public comment period has ended through our site. You can still submit a comment directly through the Federal Register’s site. If you are interested in getting involved with this campaign, add your info below and we will follow up with you.

ADD YOUR INFO BELOW

BY FILLING OUT THIS FORM, YOU ARE AGREEING TO LET ROC SUBMIT A COMMENT TO THE DEPARTMENT OF LABOR ON YOUR BEHALF.

WHAT PEOPLE ARE SHARING

Heather Heatherson

“I spend two hours a night on average doing side work. We need less side work!” – Server from Orlando, FL

Rachel Rachelson

“Can’t believe all of this side work. Something has to change.” – Server from San Antonio, Texas

Anne Motlow

“Not only does tipped minimum wage side work add hours of essentially free labor to servers’ shifts, but it also puts pressure on overworked managers to cut staff and do the side work themselves. I have personally seen an increase in manager burnout due to this dynamic. In order to provide a fair working environment and increase staff retention, many managers end up overextending themselves. A fair side work wage would hold owners accountable and create better working conditions for all employees.”

Domonique Hayes

Hayden Smith